To all we hope this Market update finds you well.

Let me start by saying the markets and market intel have been very fluid and dynamic. Clearly sending mixed signals from one week to the next. We are being careful to not update via an everyday play by play, but allowing more time in between multiple events helping to create a clearer read into the market trends.

2023 was an interesting year where we witnessed some interesting factors at play. Some appearing to be in direct conflict with the other.

We digress. Crude Oil Cost traded in a very tight band width in 2023 with only a few exciting months all while we had a relatively balanced Base Oil supply situation with very strong pricing firmness. The pricing firmness on the base oil was a direct result of having to compete within the refinery against very strong Diesel Fuel Sales & Margins. Not all things last forever as we all well know.

A more interesting fact is that 2023 proved to be the lowest Lubricant production year since 1997. A demand slump stimulated by a slowing global economy brought on by too many factors to list here, but all were seemingly obvious. Yet during this time, demand appeared to be in pretty good shape on US soil at least through Mid-November. December and January have proven to be far less robust.

In December ICIS Base Oil Postings GI- GIII reductions were announced with very little fanfare all while a flurry of aggressive pricing activity was lurking and brewing in the background. Refiners clearly were reacting to the inventory buildup within their supply pipeline.

Since muted demand comes with many definitions, we can conclude that we are feeling the impacts of multiple dynamics in play all at once.

What is the current state of the market and where will it take us?

1. We are hearing from across many channels covering a diverse contact base of Retailers, Wholesalers, Jobbers, and a fair number of Blenders themselves whom are echoing that business is muted. Some say sluggish while others are saying down YOY. Meanwhile we need to remember that many of these channels are still in the act of reducing inventory. So, this too may be adding to a weaker demand situation as it cascades into the market’s channels reverberating back upstream to the refiner. This cascading effect adds to the momentum and felling of “less and weaker” demand at least for now until the oversupply is addressed and balance is brought to order. Truly just part of another cycle and one we have not seen in a while. And some point a new strike point will turn this situation around.

2. Additionally, we are hearing and seeing very aggressive price posturing where majors are pushing to rid themselves of the supply overhang they are currently grappling with. Global Arbitrages are still wide and deep exacerbated by a slowing China economy and a very weak European economy. Meanwhile the shipping lanes are feeling the sting of Shipping Cost increases arising from the Panama Canal Drought and the Suez Canal attacks directly impacting longer routes and lead times which again add more cost to the ride. The market price posturing is still working its way through the channel networks and likely will persist till at least late February early March. This should allow enough time for refiners to balance the markets and rid itself of any overhanging excess inventory while relying on (and/or hoping for) a robust summer seasonal demand build-up which typically starts late Feb early March timeframe. Think in 90 day transitioning time frame. If this does not happen, and buyers are still opting to work from the middle of the tanks, then we will see more of the same until the excess supply flushes through the system or refiners may make the decision to reduce base oil production to match demand. An option BTW that brings in another set of dynamics that can possibly push the market into turmoil.

3. A question then; When the Summer Seasonal build up starts, will base oil price policies remain aggressive through the summer or simply taper off earlier allowing the normal cost mechanisms to come back into play? This all depends on what the refiners see from the helm. The obvious nature of the market today reflects much of the weakness in China and in Europe with additional arbitrage barrels splashing on US soil. Will the USA follow economically or have we already factored this into last years and this year’s playbook?

4. Buyers are smart. They understand the ebb and flow of the markets. We suspect that many of today’s blenders where they can, have emptied tanks to their lowest manageable point and are perched and ready to fill tanks when they feel the base oil market has bottomed. This will allow the buyers to be aggressive in their inventory builds when the timing is ready. But is it? Is there more downward pressure and can the market wring out the overhang intime for the summer?

5. Last year we saw an interesting factor in play whereby Base Oils barely reacted to crude cost yet were highly influenced by the larger than normal Diesel Fuel Margins that ALL refiners enjoyed. So do not forget, that refinery managers go to where the margin is best. As in this case IF Diesel garners better net backs, the refinery manager looks to their base oil sales team and say get better margins or lose supply feed. This was the case last year with Europe’s heavy lifts of diesel was one of base oils main competitor thereby keeping pricing firm.

6. Other factors are brewing as well that may offer more competitive resistance to base oil scene. On November 12th 2023 the LSVGO Premium to WTI was $8.40 vs Jan 30 2024 which was $19.05. That is a whopping 127% Rise. Base Oil postings have gone down during this time frame yet premiums to WTI is higher. That means the refiners have an incentive to direct more LSVGO to the direction that makes them more profit. Again, another classic base oil competitor.

7. We feel we are in a true “supply:demand” market as of now. This could change tomorrow like we said, its fluid. However, the fact is that the majors have not reacted and used the many reasons we stated to increase base pricing, proving that the current overhang of supply is outweighing demand thus creating downward pressure to move product for now.

This is a lot to take in. If you have been in the base oil arena for a while, one realizes we do not know what we do not know. But partnering up with a great supplier makes all the difference in helping you navigate the Base Oil Supply waters. We invite you to reach out to us so we may have an open dialog allowing us to be a part of your base oil supply needs.

Many Insiders are stating that the overall base oil market has length with downward pressure. Domestically and internationally attributed to what many are saying mute & weaker overall demand compounded by the slowing Global Economy. But it is like a mixed bag. Light and mid vis shows more length while with some, Heavy Vis has some length while seeking balance. All are suggesting that March forward will define the remainder of the years outlook all things being equal.

RECENT HEADLINES

US Refineries

Chevron Returns Record Cash to Investors as Oil and Gas Output Hits New High

By Tsvetana Paraskova – Feb 02, 2024,

Chevron production records in 2023, as it reported its second-highest yearly earnings last year and fourth-quarter profits beating consensus estimates. Chevron reported on Friday adjusted earnings of $6.5 billion, or $3.45 per share, for the fourth quarter 2023, compared to adjusted earnings of $7.9 billion, or $4.09 per share for the same period of 2022. Reported earnings declined compared to last year primarily due to lower upstream realizations, losses from decommissioning obligations for previously sold assets in the U.S. Gulf of Mexico, higher U.S. upstream impairment charges mainly in California, and lower margins on refined product sales, the supermajor said, confirming a warning from January that it would take an up to $4 billion impairment in Q4.

Exxon Beats Profit Forecasts With Strong Q4 Earnings

By Tsvetana Paraskova – Feb 02, 2024, 6:41 AM CST

ExxonMobil (NYSE: XOM) posted higher-than-expected earnings for the fourth quarter, while its full-year profit was the second-highest in a decade, as the U.S. supermajor boosted its Guyana and Permian production and achieved record annual refinery throughput. Exxon reported on Friday fourth-quarter 2023 earnings of $7.6 billion, or $1.91 per share assuming dilution. As previously flagged, the U.S. supermajor’s Q4 earnings were impacted unfavorably by identified items of $2.3 billion, including a $2.0 billion impairment as a result of regulatory obstacles in California that have prevented production and distribution assets from coming back online.

NON US Refineries

China’s Private Refiners Struggle Amid Faltering Economy and High Oil Prices

By Tsvetana Paraskova – Feb 01, 2024, 8:31 AM CST

Many private refiners in China, often referred to as ‘teapots’, have started this year struggling, squeezed between higher prices for importing sanctioned oil and depressed refining margins amid sinking domestic diesel prices in the face of a faltering Chinese economy. China’s economy has struggled to take off and now the coming Lunar New Year holiday later this month has had operators reduce industrial activity. These factors have led to a collapse in diesel prices in China, and as a result—a crash in diesel refining margins, which have been typically the pillar of profitability for the private Chinese refiners, Bloomberg reports.

European refineries suffer from under-investment

Published date: 05 January 2024

European refiners are shutting capacity again, but tight diesel supply could give them a last hurrah, writes Benedict George.

Falling demand for fuels has been dissuading many European refiners from investing in their plants, with the result that assets are deteriorating and some closing altogether. But extraordinary margins are still achievable in the short term for those that can stay on line. Argus reported 14 separate incidents in which a European refining unit had to close because of a fire, leak, power outage or other accident in 2023 — up from 12 in 2022. Under-investment has been exacerbated by circumstances. European costs are uncompetitive against those in the Middle East or Asia. European oil demand is declining, but growing in those other regions. Ageing units have been undermaintained since 2020 because of the pandemic and then a reluctance to miss out on resurgent margins by halting units for upkeep.

Source: https://www.argusmedia.com/en/news/2525010-european-refineries-suffer-from-underinvestment

THE CRUDE SIDE

Oil Prices Drop, Recover on Gaza War Ceasefire Proposal Rumors

By Julianne Geiger – Feb 01, 2024, 1:01 PM CST

Oil prices began tanking on Thursday afternoon as news was reported by Al Jazeera that Israel and Hamas had agreed to a ceasefire proposal that could put an end to the geopolitical premium that has buoyed oil in recent months. Al Jazeera deleted the Tweet a short while later, with oil prices reclaiming at least some of the losses. While traders may have gotten used to—and perhaps immune from—fear-based geopolitical events that merely threaten to raise the price of oil without creating actual supply problems, today’s drop in crude oil prices suggests that there was at least some component of a geopolitical risk premium present in the current price of oil—a premium that is quickly vanishing. Brent crude oil had fallen to below $79 per barrel by 1:20pm ET, a drop off of 2.05% in a single day, landing at $78.90 at that time. The price of a WTI crude barrel had fallen by 1.95% at that same time, to $74.37, a loss of $1.50 per barrel.

Saudis to Lower Crude Oil Prices for February

by Bloomberg; Sherry Su, Alfred Cang & Anthony Di Paola

Saudi Arabia will cut key crude prices for buyers in all regions, including its main Asia market, for February amid persistent weakness in the market. Oil consumption typically eases during February and March, with refiners using the period to shut some facilities for periodic maintenance. At the same time, strong global supply, including from the US, is raising the likelihood of a surplus that forced the OPEC+ group, led by Saudi Arabia and Russia, to extend output cuts into this year. State producer Saudi Aramco reduced its flagship Arab Light price to Asia by $2 to $1.50 a barrel above the benchmark. That’s bigger than a $1.25 a barrel reduction estimated in a Bloomberg survey of refiners and traders. Aramco also cut all prices for February delivery to Northwest Europe, Mediterranean and North America.

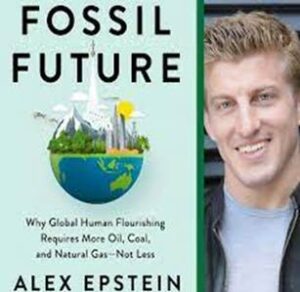

SUGGESTED READING

The New York Times bestselling author of The Moral Case for Fossil Fuels draws on the latest data and new insights to challenge everything you thought you knew about the future of energy.

For over a decade, philosopher and energy expert Alex Epstein has predicted that any negative impacts of fossil fuel use on our climate will be outweighed by the unique benefits of fossil fuels to human flourishing–including their unrivaled ability to provide low-cost, reliable energy to billions of people around the world, especially the world’s poorest people.

And contrary to what we hear from media “experts” about today’s “renewable revolution” and “climate emergency,” reality has proven Epstein right:

- Fact: Fossil fuels are still the dominant source of energy around the world, and growing fast—while much-hyped renewables are causing skyrocketing electricity prices and increased blackouts.

- Fact: Fossil-fueled development has brought global poverty to an all-time low.

- Fact: While fossil fuels have contributed to the 1 degree of warming in the last 170 years, climate-related deaths are at all-time lows thanks to fossil-fueled development.

What does the future hold? In Fossil Future, Epstein, applying his distinctive “human flourishing framework” to the latest evidence, comes to the shocking conclusion that the benefits of fossil fuels will continue to far outweigh their side effects—including climate impacts—for generations to come. The path to global human flourishing, Epstein argues, is a combination of using more fossil fuels, getting better at “climate mastery,” and establishing “energy freedom” policies that allow nuclear and other truly promising alternatives to reach their full long-term potential.

Today’s pervasive claims of imminent climate catastrophe and imminent renewable energy dominance, Epstein shows, are based on what he calls the “anti-impact framework”—a set of faulty methods, false assumptions, and anti-human values that have caused the media’s designated experts to make wildly wrong predictions about fossil fuels, climate, and renewables for the last fifty years. Deeply researched and wide-ranging, this book will cause you to rethink everything you thought you knew about the future of our energy use, our environment, and our climate.

WE’VE COME A LONG WAY!

The Signal Fluid Solutions team would like to take this time to thank you for your business and thank you for allowing us to be an important part of you supply team.