Dear Readers,

Welcome to the January 2025 edition of Fueling the Future, where we explore the latest shifts in the U.S. fuel oil, bunker fuel, and crude oil markets.

With the start of a new year comes a blend of opportunities and challenges, driven by evolving market dynamics, supply chain adjustments, and global policy shifts. Let’s dive into the key trends and factors shaping the year ahead.

Crude Oil Market Overview

Current Trends:

- Refinery Adjustments: U.S. crude refinery inputs in January averaged lower than late 2024 levels, as seasonal maintenance and operational recalibrations took hold. Refinery utilization hovered around 85.9%, reflecting reduced activity from year-end peaks

- Inventories Tighten: U.S. commercial crude oil inventories remain below the five-year average, underscoring ongoing tightness despite an uptick in imports. Distillate inventories are also trending lower, amplifying concerns over regional supply shortages heading into Q1 .

Looking Ahead:

The signs point to a market in transition. While production remains resilient, logistical challenges and policy shifts may tighten crude availability, particularly as export demand remains robust. Balancing domestic supply priorities with growing international needs will be key for refiners and producers.

Bunker Fuel Insights

Market Dynamics:

- Weather Disruptions: January’s harsh winter conditions created delays in key U.S. bunkering hubs, including Houston, where high winds and cold weather impacted barge operations. While conditions are improving, lead times remain extended in several areas.

- Global Supply Shifts: The Asia-Pacific bunker market experienced steady demand growth, particularly for low-sulfur blends. Regional suppliers are navigating rising feedstock values while striving to meet growing shipping activity

Future Projections:

As the shipping industry continues to rebound, steady growth in bunkering activity is expected. The global push toward sustainable fuels and low-sulfur options will further shape the market as regulations tighten and technology evolves.

Fuel Oil Sector Highlights

Current Landscape:

- Rig Count Declines: U.S. oil and gas drilling activity fell to its lowest point since late 2021. Producers are prioritizing operational efficiency and shareholder returns over new expansion, reflecting caution amid current price signals.

- Policy Recalibrations: New policy discussions are reshaping the energy landscape. While efforts to expand oil drilling continue, parallel investments in renewables and emissions-reduction initiatives are gaining traction across key markets.

Outlook:

The broader fuel oil sector faces a balancing act between maintaining traditional output levels and adapting to shifting regulatory and market demands. Expect a cautious approach to production growth as companies manage both economic and environmental pressures.

THE CRUDE SIDE: U.S. AND GLOBAL DYNAMICS

- Resilient U.S. Production: Domestic crude production has held steady despite lower refinery inputs, demonstrating the adaptability of U.S. shale operators. However, producers are keeping a watchful eye on international price trends and geopolitical developments.

- Geopolitical Factors: With strategic stock releases winding down, crude prices could face upward pressure in the months ahead, particularly if geopolitical tensions continue to simmer. OPEC+ production decisions and sanctions enforcement will remain critical influencers on global flows.

- Demand Recovery: A revival in travel and logistics has boosted jet fuel demand, with year-over-year growth outpacing other refined products. This trend signals recovering global activity that could buoy overall crude consumption.

FINAL THOUGHTS

As we navigate January 2025, the energy markets are setting the stage for a year of cautious optimism. From evolving production strategies to policy recalibrations and global trade realignments, the road ahead offers both opportunities and challenges. Staying informed and proactive will be key to thriving in this ever-shifting landscape

FUN FACTS ABOUT WHALE OIL AND THE START OF THE OIL INDUSTRY IN THE USA

- Whale Oil Was King – Before petroleum, whale oil was the primary fuel for lamps in the 18th and early 19th centuries. It burned cleanly and was highly sought after, making whaling a booming industry.

- Lighting the Way – Whale oil wasn’t just used for lamps; it was also a key ingredient in soap, lubricants, and even candles, which were prized for their bright, smoke-free light.

- The Decline of Whaling – As whale populations declined and the cost of whale oil soared, people began searching for alternative fuels, setting the stage for the oil industry.

- Kerosene Changed Everything – In 1846, Abraham Gesner discovered kerosene, a fuel that could be distilled from coal and later from crude oil, offering a cheaper and more efficient alternative to whale oil.

- Drake’s Well Revolution – The first commercial oil well, drilled by Edwin Drake in 1859 in Titusville, Pennsylvania, produced crude oil that could be refined into kerosene, signaling the beginning of the modern oil industry.

- Oil Saved the Whales – The rise of crude oil as an alternative to whale oil is often credited with helping save whale populations from near-extinction.

- The First Oil Rush – Just like the Gold Rush, the discovery of crude oil in Pennsylvania sparked an “Oil Rush,” with thousands flocking to drill wells and make their fortune.

- “Black Gold” – Crude oil was nicknamed “black gold” because of its value as a replacement for expensive whale oil and its wide range of uses.

- Transportation Revolution – The transition from whale oil to petroleum products was accelerated by the invention of pipelines, allowing crude oil to be transported more efficiently than barrels on horse-drawn wagons.

- From the Sea to the Ground – Whaling ships gave way to derricks and rigs as the world’s primary energy source moved from the ocean to underground.

- Whale Oil Medicine – Believe it or not, whale oil was also used as a health remedy, believed to cure ailments like rheumatism and skin conditions before crude oil products replaced it.

- The First Oil Monopoly – As petroleum overtook whale oil, John D. Rockefeller’s Standard Oil Company emerged as a major player, creating one of the first monopolies in the oil industry.

SUGGESTED READING

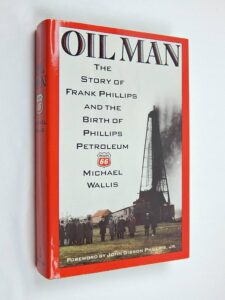

“OIL MAN: THE STORY OF FRANK PHILLIPS AND THE BIRTH OF PHILLIPS PETROLEUM” BY MICHAEL WALLIS

DIVE INTO THE CAPTIVATING STORY OF FRANK PHILLIPS, THE VISIONARY BEHIND PHILLIPS PETROLEUM. IN “OIL MAN: THE STORY OF FRANK PHILLIPS AND THE BIRTH OF PHILLIPS PETROLEUM” BY MICHAEL WALLIS, EXPLORE HOW AN AMBITIOUS ENTREPRENEUR HELPED SHAPE THE AMERICAN OIL INDUSTRY. FROM THE GRIT OF THE OIL FIELDS TO BUILDING AN ICONIC COMPANY, THIS BIOGRAPHY OFFERS A FASCINATING GLIMPSE INTO THE INDUSTRY’S ROOTS.

WE’VE COME A LONG WAY!

The Signal Fluid Solutions team would like to take this time to thank you for your business and thank you for allowing us to be an important part of you supply team.

Tyler Jordan – Oil Trading Manager – 909-203-0237