OUR OBSERVATION

Readers, I hope this newsletter finds you well.

Since our last newsletter in late August, we have seen reductions for key US Refiners on GI, GII & GIII products ranging from ($0.10) CPG on the low to ($0.50) CPG on the high. Suggesting they are trying to bring relevance back to posted pricing.

Despite price reductions there still appears to be a gap between domestic posting’s, market, and export pricing. One of the key drivers of the gap appears to be driven by softer demand. We in fact forecasted such for the 4th quarter and is generally in sync with normal seasonal slowdowns. We do feel there are a few more factors at play other than just a seasonal slowdown, however.

The USA and abroad have seen many market sectors showing signs of economic slowness. Witnessing announcements made by major retailers of shutting doors or going into bankruptcies has been sobering driven by consumers’ lack of spending compounded by higher interest rate debt continues to weigh in on our economy.

Meanwhile even with a few close Hurricane calls, the market will soon have to burn off the extensive hurricane buildup which will be spilling back into the marketplace. So, the excess inventories will be right sided yet at same time slowing the need to blend and replace products. IE Softer demand ahead.

Additional headwinds are Imports from Asia and the UAE for GII & GIII continue to land on US Soil as they try to find higher net backs in different regions. You take all of this PLUS a pending presidential election is making things very interesting while looking ahead for Demand Clarity.

Currently from the refiner’s perspective of GII the tightness on 100 & 600 seems to have eased up and is more balanced than projected. 220 depending on the refiner you speak with is balanced or has some length.

We have seen Re-Refiners step into markets where and when 100 vis virgin base oil was short at very aggressive pricing. GIII 4cst has length along with some balancing occurring on some 6cst and 8cst source points while demand is working to even out domestic production and imports.

The indexes are slowly adjusting to the previous months US Domestic Postings announcements whereby, Market and Export pricing has slowly adjusted downward as expected.

From the crude platform we have seen Brent down to the lowest of this month which is $74:Bbl and WTI Trailing behind at $70:Bbl. This is inclusive of the risk premium factored into the barrel due to the Israel and Iran situation.

US Fuel demand is still down despite the unexpected spike in consumption in Florida due to Hurricane Milton. Traders still seem to be less aggressive at grabbing every data point for a cost increase.

From the buyer’s perspective we are seeing blenders taking a conservative approach to inventory buildup as to be expected with the current dynamics of the market. Plus, in general blenders remain conservative on build up towards years end due to yearend tax strategies. This will continue for the remainder of the quarter, and some are still projecting a conservative approach for the first quarter of 2025. With all the factors at play we are seeing great deals in the marketplace for blenders to take advantage of. This certainly is in favor of buyers for the remainder of the year and possibly the first quarter of 2025.

As for us, we are working closely with all our customers helping them navigate the waters ahead. 2024 has proven to be dynamic on its own terms. As always here and everywhere something is happening that impacts our world and supply chain.

RECENT HEADLINES

U.S. REFINERIES

Phillips 66 Los Angeles-area refinery to close next year

Phillips 66 announced Wednesday that it will close its southern Los Angeles County refinery operations next year.

Citing uncertainty about future sustainability of the refinery complex, which includes two facilities linked by a pipeline in Wilmington and Carson, the company’s chair and CEO announced the decision in a statement.

We understand this decision has an impact on our employees, contractors and the broader community,” said CEO Mark Lashier. “We will work to help and support them through this transition.”

About 600 employees and 300 contractors work for the refinery complex — a crude-oil processing facility in Carson and a separate facility in Wilmington where the processed oil becomes finished products. Continue Reading Here

ExxonMobil Eyes $500M Sale of Bakken Shale Assets in North Dakota

Exxon Mobil Corporation XOM, the largest oil producer in the United States, is reportedly looking to sell some of its assets in North Dakota’s Bakken shale formation. According to a Reuters report, the company aims for a deal that could fetch at least $500 million.

ExxonMobil is exploring market interest for a portion of its Bakken shale holdings, which include approximately 137 operated and 676 non-operated and royalty wells across 49,000 net acres in North Dakota. The planned sale could fetch more than $500 million, according to the report. This move is part of XOM’s strategy to realign its portfolio after the $60 billion acquisition of Pioneer Natural Resources in May. Continue Reading Here

Chevron targets 1 million boe/d Permian production by 2025

Chevron Corp. has targeted Permian basin production of 1 million boe/d by 2025. The company is centering its efforts in New Mexico on the Delaware basin end of the Permian.

“At the end of day, we expect to get more out of the ground than we could in other areas of the Permian,” said New Mexico asset manager Duncan Healey in discussing the area’s high-quality source rock. “[It]’s thick and deep, which means it us under high pressure and can force the oil and gas out easier.”

Where possible, Chevron says, it is using electrical compressors rather than natural gas-fueled ones. The company also claimed reduced carbon intensity in its regional hydraulic fracturing operations. Continue Reading Here

NON U.S. REFINERIES

Pemex Budget Cuts Threaten Oil Production

Mexico’s state-owned oil giant, Pemex, is facing a significant reduction in its upstream budget for the fourth quarter.

According to internal documents, the company plans to cut spending by 20%, or Mxn 26.78bn ($1.38bn), a move that is expected to impact short-term crude production. This cutback follows instructions from Pemex’s new upstream head, Nestor Martinez, to scale back major well repairs and seismic data contracts.

Pemex, which produced 1.73 million barrels per day (bpd) of crude and condensates in August, could see production drop by around 5,800 bpd as a result of these cuts, although the curtailment could increase if critical well repairs are delayed, potentially halting production from some wells. Continue Reading Here

Shell’s Planned Sale Of Rosneft’s Refinery In Germany Hits A Wall

Shell Plc’s (NYSE:SHEL) planned sale of a stake in the Schwedt refinery in Germany is facing delays due to pending lawsuits by third parties, Reuters has reported. Shell’s planned sale of its 37.5% stake in the refinery to Britain’s Prax Group, was expected to close in the first half of 2024; however, the deal has hit a snag after Berlin stripped majority owner Rosneft of its control, but not its shares, and put it under a trusteeship shortly after Russia invaded Ukraine in 2022. The lawsuits include an attempt by Rosneft to prevent the sale to Prax. Continue Reading Here

Aramco Cancels Saudi Chemical Project as It Focuses on Asia

Saudi Aramco has canceled plans to build a refinery and chemicals project in the kingdom and is reviewing three others as it evaluates spending plans with a focus on expanding in Asia.

Aramco and its unit Sabic will not go ahead with the planned 400,000 barrel-a-day facility at Ras Al Khair on Saudi Arabia’s Gulf coast, and a proposal to move the project to Jubail has also been shelved, according to people with knowledge of the situation. Continue Reading Here

THE CRUDE SIDE

U.S. crude prices fall more than 4% as Israel is not expected to strike Iran’s oil industry

U.S. crude futures fell more than 4% on Tuesday, after Israel reportedly told the U.S. that it is not planning to strike Iran’s oil facilities, relieving fears that a major supply disruption in the Middle East is on the horizon.

Israel plans to limit its retaliatory strikes in Iran to military targets and does not plan to hit the Islamic Republic’s oil industry or its nuclear facilities, three senior Biden administration officials told NBC News.

Oil prices spiked earlier this month after Iran launched a ballistic missile attack against Israel, raising fears that Israel’s response could lead to a cycle of further escalation that disrupts crude supplies in the region. Continue Reading Here

OPEC+ Spare Capacity Could Cushion Oil Markets

The crude oil market faces a critical juncture, driven by escalating geopolitical tensions in the Middle East and questions over global spare production capacity. Traders are caught between the potential for significant supply disruptions and the possibility that OPEC+ and other producers could step in to mitigate shortages. As conflict threatens key oil-producing regions, market participants are watching closely for signals of both price surges and stability.

Middle East Conflict: A Looming Supply Disruption Continue Reading Here

FUN FACT

Here are 10 things you may not have known about the oil and natural gas industry in Texas:

1. Origins of Texas Oil: The earliest discoveries of oil in Texas began with Native Americans. They first found it seeping through the soil and believed it had medicinal properties.

European explorers learned about this crude oil from the Native Americans. Survivors of the DeSoto expedition found oil floating on the water near the Sabine Pass in 1543 and used it to caulk their boats.

2. Top Two Regions: Most of Texas’ oil and natural gas resources originate from the Eagle Ford Shale in South Texas and the Permian Basin in West Texas.

3. Permian Basin: The Permian Shale Basin is the largest crude-producing region in Texas, and is one of the most significant oil-producing regions globally. It has been a crucial driver of Texas’ oil production, contributing to its ranking as a leading oil-producing state.

4. Eagle Ford Shale: The Eagle Ford Shale was known for many years but did not gain attention as a viable oil and gas source until the early 2000s.

Advances in horizontal drilling and hydraulic fracturing (fracking) technologies allowed energy companies to extract oil and gas from unconventional shale formations such as Eagle Ford. It has become one of the most important and productive shale formations in the United States since being drilled in 2008.

5. East Texas Field: The East Texas Field, discovered in 1930, is one of the largest and most abundant oil fields in the United States. The area is located within and around the cities of Tyler, Kilgore and Longview, Texas. It has produced over 5.4 billion barrels of oil to date since its discovery.

6. Spindletop Gusher: The most famous date in Texas petroleum history is Jan. 10, 1901, when the Lucas Geyser erupted in the Spindletop oil field. This astonishing geyser gushed out mud mixed with natural gas and oil, producing thousands of barrels of oil. It was one of the largest oil gushers in history.

7. Texas Oil Boom: One year after the Lucas (Spindletop) Geyser marked the beginning of the oil boom in Texas. Spindletop oil field produced 94% of Texas’ oil in 1902. Oil production began to rapidly spread across the state, leading to a population influx, rapid economic growth and the establishment of numerous oil companies.

8. Plenty of Resources: Did you know that oil and natural gas has been produced and discovered in most areas across the entire state of Texas?

The United States soon became the world’s leading oil producer, largely due to these discoveries throughout multiple regions in Texas. While there are more concentrated regions, oil and gas has been found almost everywhere in the Lone Star State.

9. Natural Gas Reserves: Texas is not just a major oil producer. It also boasts significant natural gas reserves. The state’s natural gas production has contributed substantially to the United States’ overall gas output.

10. The Energy Capital: Houston, Texas, is known as the “Energy Capital of the World.” In addition to its reputation for some of the best and most diverse foods, Houston hosts the headquarters of numerous oil and gas companies too.

It is a major hub for energy-related activities, including trading and finance. One reason for this is because the Texas oil boom began in Beaumont, Texas, located just 90 miles east of Houston. This is where the famous Lucas (Spindletop) Geyser erupted in 1901.

Houston, Texas.

The oil and gas industry is continuously evolving. A noteworthy contribution to this industry comes from many shales and basins within Texas regions.

Texas’ historical and current presence in oil and gas production remains undeniable, and will continue to play a significant role in the United States economy for years to come.

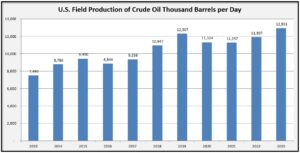

Follow the Numbers.

SUGGESTED READING

Boom or Bust: Narrative, Life, and Culture from the West Texas Oil Patch Kindle Edition by Sheena B. Stief

A vast number of studies have documented the economic and geological effects of oil production, but the impact of boom-and-bust cycles on individuals and communities has received less attention. Boom or Bust remedies this gap by highlighting the personal experiences of those directly affected in an economy dominated by oil and natural gas production.

The Permian Basin is one of the largest oil-producing regions in the United States. People who live there have benefited from explosive growth, only to see opportunities vanish with sudden industry downturns. In 2016, the National Endowment for the Humanities funded a grant for the study and collection of energy narratives in this economically volatile region. Boom or Bust derives from that community initiative and offers a unique contribution to the developing field of energy humanities.

The oil-field industry may seem to be all about numbers, but as Boom or Bust demonstrates, residents of oil-and-gas country, whether they work in the oil field or not, are at the mercy of an ever-shifting economy. When the price of oil rises, companies move in and newcomers flood the area, expanding the employment force. And as the population booms, so does the infrastructure of cities. When prices drop, though, families must make difficult choices: whether to stay put or follow the oil to another location. With the ensuing declines in population, small businesses close their doors and unemployment levels rise. Despite the inevitable declines and despite the increase in alternative energy resources, many West Texans feel a sense of pride that borders on patriotism. Boom or Bust reveals the full complexity of boomtown culture.

WE’VE COME A LONG WAY!

The Signal Fluid Solutions team would like to take this time to thank you for your business and thank you for allowing us to be an important part of you supply team.