OUR OBSERVATION

Readers, I hope this newsletter finds you well.

Since our last Newsletter back in early June, we have not seen any key US posting changes up or down by any of the major base oil producers suggesting they are still analyzing market conditions while grappling with the disconnect between prices on the street vs postings.

GII “Export” Pricing did move however with a small 5 CPG increase on 100 & 600 vis grades recently. This appears to support a clearing of the overhang for now. However, there is noise coming from across the pond. Asia base oil stockpiles have risen with recent lowering in demand from China which supports some key producers thinking that this overhang of supply may bleed back into the market at some point in the future. Some feel this overhang will splash back on US Soil late 3rd Qtr to 4th Qtr this year. As we learn more we will report.

Meanwhile, two major GII US producers have corrected their production hiccups on the 100 Vis range which means and improvement in supply for the near term.

The Recent hurricane Beryl did cause some Terminal Disruptions in the last few weeks yet thankfully only a near miss for the Refinery side.Which luckily did not damage any key supply infrastructures. Thus, causing little strain on the hurricane supply buildup. None the less, Beryl was a strong reminder of what has been predicted to be an active hurricane season that reinforces the refineries worry about the severity of the remainder of the season. This will keep a risk factor built into prices until it most likely unwinds in 4th quarter.

From the Crude Platform, Wall Street lately seems confused on Crude Futures all while running with any story or data point that can support a Bullish mentality. From a market perspective there have been no real takers as crude continues to maintain a very tight bandwidth on the trading flow from early June to now. This helps to substantiate the building negative economic data supported by weakening global demand.

Buyers are maintaining a very conservative approach to inventory build. Purchase activity appears consistent with most ILMA members gladly stating with relief that the excess in inventory imbalances have been addressed and they see a clear path for what they need for the remainder of the year. This is a positive thing as it helps the buyers to better forecast their needs and obviously improves the cash flow within their businesses.

As for us, we are working closely with all our customers helping them navigate the waters ahead. 2024 has proven to be dynamic on it owns terms. As always here and everywhere something is happening that impacts our world and supply chain.

We do deeply appreciate the opportunity to work with you and your team.

RECENT HEADLINES

U.S. REFINERIES

Can a ballot initiative transform Richmond from a refinery town?

Sacramento Democrats may have abandoned plans to have the state’s biggest fossil fuel producers pay for their environmental and health impacts, but voters in the bayside city of Richmond, California, will still have the chance to do so this November.

An initiative placed on the Richmond ballot last month would tax the Chevron refinery, one of the largest in the state, $1 for each barrel of oil processed within city limits. While other local governments have attempted to make polluting industries pay more for the right to operate in their communities, boosters of the Richmond proposal say it offers a chance to transform a city defined by industry into something new. Continue Reading Here

West Coast Summer Refinery Margins Decline Despite Reduced Capacity

This spring, California refinery crack spreads for gasoline and diesel dipped below average despite shrinking refinery capacity on the West Coast (PADD 5). Crack spreads are the difference between refined product prices and an equivalent volume of crude oil. We use them as a measure to estimate refinery margins based on commodity market conditions. The decline in West Coast crack spreads stems from growing regional gasoline inventories and the increasing use of biofuels in place of conventional, petroleum-based diesel fuels in California. Continue Reading Here

Exxon shut Joilet, Illinois, refinery after power outage

EW YORK, July 16 (Reuters) – Exxon Mobil (XOM.N), shut down its 251,800-barrel-per-day refinery at Joliet, Illinois, due to a power outage after a storm, according to a filing late on Monday. The loss of power caused a flaring incident on Monday night, the filing showed.

Exxon did not immediately respond to a request for comment. The plant went down due to heavy wind and rain, two industry sources said. A severe storm passed through Joliet on Sunday, according to the National Weather Service, leaving thousands without power. Continue Reading Here

Trump Vows to Boost U.S. Production if Elected President

We have more liquid gold than anybody,” Trump told Bloomberg Businessweek.

“We need energy at low prices. The advantage we have all over almost every country including the very large ones is that we have more energy than anybody. We have more of the real energy, the energy that works,” the former president vying for another term in office said.

“Wind does not work. It’s too expensive,” said Trump, claiming that solar and wind farms are neither too good for the environment, nor too suitable to provide energy at low costs and prices.

Although Trump was light on details regarding domestic U.S. energy issues, it became clear that he would continue to support American oil and gas production if elected president.

If he wins in November, Trump is set to overturn or at least try to dismantle many of President Biden’s energy and climate policies, including methane rules, the pause on new LNG export permits, EV mandates, federal oil and gas leasing, and even parts of the Inflation Reduction Act.

However, dismantling the IRA would first need a Republican-controlled Congress with both House and Senate. And even then, it could be difficult to scale back or scrap the incentives, as they mostly benefit projects and jobs in Republican states, analysts say. Continue Reading Here

NON U.S. REFINERIES

Searing Heat Triggers Fuel-Supply Worries at Oil Refineries in Europe and Beyond

Temperatures in Europe are getting close to levels at which some oil refineries would have to start making less fuel. Greece is battling wildfires and the nation’s capital could see temperatures above 40C (104F) in the coming weeks. In Poland, heat may soon exceed the point at which the country’s top fuel supplier can run its refineries normally. Macquarie Group estimates that heat-related disruption at European plants reached about 1 million barrels-a-day. Continue Reading Here

Revitalisation of African refinery sector: new capacities signal growth, new Hawilti report reveals

Following years of stagnation in Africa’s refinery sector, a resurgence is underway with significant capacity expansions attributed to key projects such as the Dangote Refinery in Nigeria, Sentuo Oil Refinery in Ghana, and the forthcoming Cabinda Refinery in Angola. This rejuvenation marks a pivotal moment in the region’s energy landscape, promising enhanced energy security and economic growth, just as petroleum products imports reached an all-time high of 2.5 million barrels per day (bpd) last year.

West Africa witnesses significant capacity growth

The commissioning of the Dangote Refinery, one of the largest single-train refineries globally, is slowly becoming a game-changer for Nigeria and the continent. With a refining capacity of 650,000 bpd, it can not only address Nigeria’s domestic fuel demand but also position the country as a major player in the regional and global supply of petroleum products.

Similarly, the commissioning of the Sentuo Oil Refinery in Ghana earlier this year further added to West Africa’s refining capacity, bringing a much-needed relief to Ghana’s energy independence after imports bills reached several billion US dollars in recent years.

The region will continue to lead refinery activity in Sub-Saharan Africa in the near future, with several modular refineries currently under expansion and in development in the sub-region. Large projects are also making progress, notably with the signing in April of a share subscription agreement between NNPC’s Port Harcourt Refining Company (PHRC) and African Refinery Port Harcourt Ltd (ARPHL) for the co-location of a 100,000 bpd capacity refinery in Nigeria. Continue Reading Here

Russian Oil Supply to Hungary Halted Due to Ukraine Sanctions on Lukoil

Despite the fact that EU pipeline crude imports from Russia are not banned by the embargo, Russia is not delivering crude oil to Hungary at present after Ukraine imposed stricter sanctions on Russian oil giant Lukoil, effectively banning it from using Ukraine as a transit for oil exports.

Lukoil was supplying Hungary with crude via the southern leg of the Druzhba oil pipeline which crosses Ukraine.

With the toughened sanctions Kyiv imposed on Lukoil in June, Russian oil does not reach Hungary now.

However, Hungary – whose Prime Minister Viktor Orban is seeking ties with Vladimir Putin and even visited Moscow earlier this month – is currently working with Russia to restore Lukoil’s oil deliveries to the central EU country, which has tried to keep “friendly” ties with Russia despite EU objections. Continue Reading Here

THE CRUDE SIDE

Japan, S. Korea refiners join China in buying Canadian TMX oil

SINGAPORE, July 15 (Reuters) – Asia’s crude oil imports from Canada’s newly expanded Trans Mountain pipeline will rise in September as major refiners in Japan and South Korea and a refinery in Brunei have bought their first cargoes alongside China, multiple trade sources said.

The purchases come after exports commenced from the expanded TMX pipeline in May which will triple the flow of crude from landlocked Alberta to Canada’s Pacific coast to 890,000 barrels per day (bpd). Owned by the Canadian government, the pipeline gives Canadian producers more access to U.S. West Coast and Asian markets while providing Asian refiners an opportunity to diversify their imports. Continue Reading Here

Crude Oil extends declines on Chinese demand concerns, WTI falls below $80

West Texas Intermediate (WTI) Crude Oil fell on Tuesday as barrel traders grow fearful at the prospect of a slowdown in Chinese demand for fossil fuels. A decline in American Petroleum Institute (API) week-on-week barrel counts helped to bolster WTI prices into a weak recovery in late Tuesday trading, but an equivalent buildup of distillate products limited bullish potential. Continue Reading Here

SUGGESTED READING

Oil: A Beginner’s Guide (Beginner’s Guides) Paperback – December 12, 2017

World acclaimed scientist Vaclav Smil reveals everything there is to know about nature’s most sought-after resource Oil is the lifeblood of the modern world. Without it, there would be no planes, no plastic, no exotic produce, and a global political landscape few would recognize. Humanity’s dependence upon oil looks set to continue for decades to come, but what is it? Fully updated and packed with fascinating facts to fuel dinner party debate, Professor Vaclav Smil’s Oil: A Beginner’s Guide explains all matters related to the ‘black stuff’, from its discovery in the earth right through to the controversy that surrounds it today.Oil: A Beginner’s Guide (Beginner’s Guides) Paperback – December 12, 2017

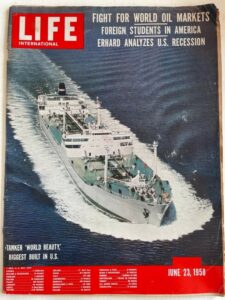

WE’VE COME A LONG WAY! OR DID WE?

Take a look at a June 1958 Life Magazine Cover and its top 3 headers. Simply stated, the more things change, the more they stay the same.

The Signal Fluid Solutions team would like to take this time to thank you for your business and thank you for allowing us to be an important part of you supply team.